You donate an item to charity, and receive a form. Then tax time comes around. Have you ever wondered, “Can I write this donation off?” You’re not alone. Thousands of donors search for answers to questions around tax deductions every year, especially as tax season approaches.

Let’s break down what’s actually deductible, how to stay compliant, and how ReSupply makes the process easier than ever.

Can You Write Off Donations? Yes—With a Few Conditions

The short answer is yes, you can claim a tax deduction for donating to qualified charitable organizations. But there are some key rules to follow:

- You must itemize your deductions. If you take the standard deduction, you can’t claim additional charitable donations.

- The organization must be a 501(c)(3). That means only donations made to IRS-recognized nonprofits qualify.

- You need a receipt. The IRS requires written acknowledgment of your donation if it’s valued over $250.

Pro tip: When you donate gently-used furniture, clothing, and household items with ReSupply, tax deductions are part of the process. All ReSupply donations go to vetted 501(c)(3) charity partners, and we automatically provide documentation for your records.

What Can You Deduct?

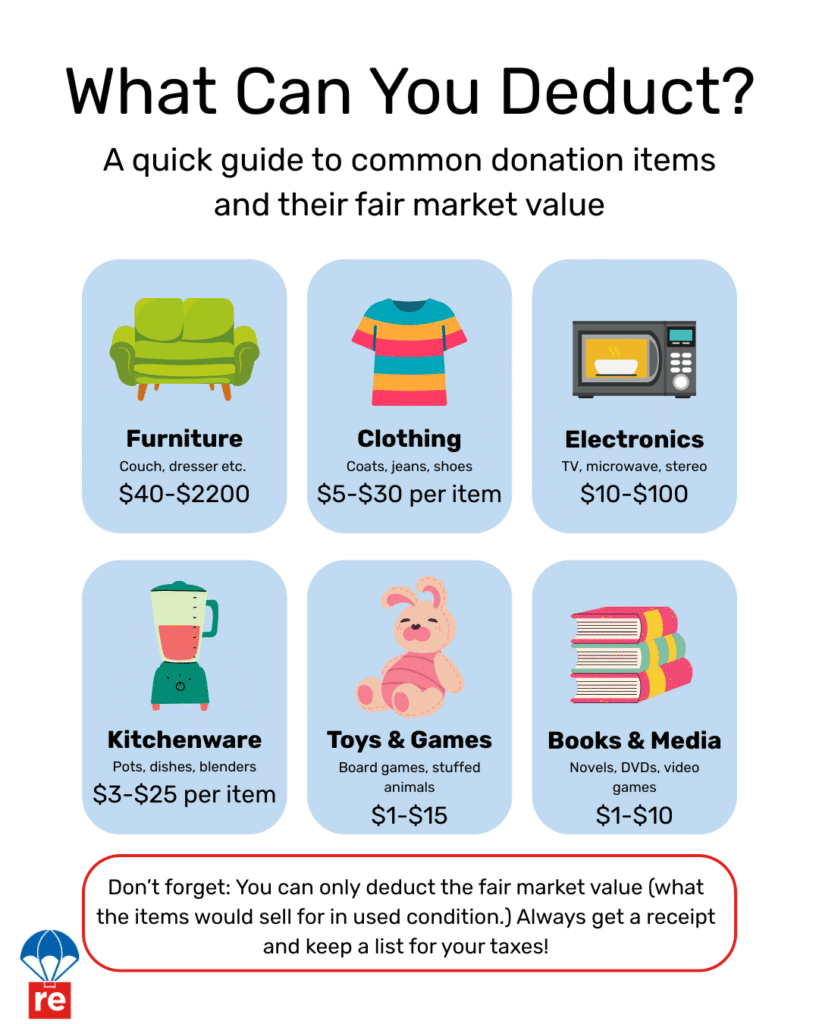

You can deduct the fair market value of household items, clothing, and furniture—essentially what someone would reasonably pay for an item in used condition. Here’s a quick look at common deductions:

Always be honest and conservative with estimates—the IRS can audit deductions that seem inflated.

What You Can’t Deduct

Some items don’t qualify for a tax write-off, even if a charity accepts them:

- Broken or unsafe items

- Trash or items in poor condition

- Services or time volunteered (unfortunately!)

- Donations to individuals or non-qualifying organizations

If you’re unsure, ReSupply’s team can help guide what’s worth donating and what’s better recycled or disposed of responsibly. Check out our article here.

How ReSupply Helps with Tax Deductions

When you book a home donation pickup with ReSupply, we make it easy to feel good and stay compliant:

- Official receipts from our charity partners

- Confirmation for your records

- Partnerships with IRS-qualified 501(c)(3)s across the country

And since we come to you, there’s no need to track down a donation center or worry about paperwork.

Real Talk: Is It Worth It?

For many people, absolutely. Donation deductions can lower your taxable income—sometimes significantly—especially when combined with other itemized deductions like mortgage interest or medical expenses.

Here’s a quick example:

- You donate a bedroom set worth $500

- You’re in the 24% tax bracket

- You save roughly $120 on your taxes

That’s a real impact, for both your bottom line and your community. It’s sustainable, economically-savvy, and the easiest method to get rid of excess stuff.

How to Claim the Deduction

Come tax time, here’s what you’ll need:

- Itemized list of donations

- Receipts or written acknowledgment

- IRS Form 8283 (if your total non-cash donations exceed $500)

If you donate high-value items (over $5,000), an independent appraisal may be required.

Ready to Donate—and Deduct?

Giving back has never been easier. Whether you’re cleaning out before a move, tackling a summer declutter, or planning ahead for tax season, ReSupply connects your donations to legitimate local charities—and gives you everything you need to file the write-off properly.